owe state taxes because of unemployment

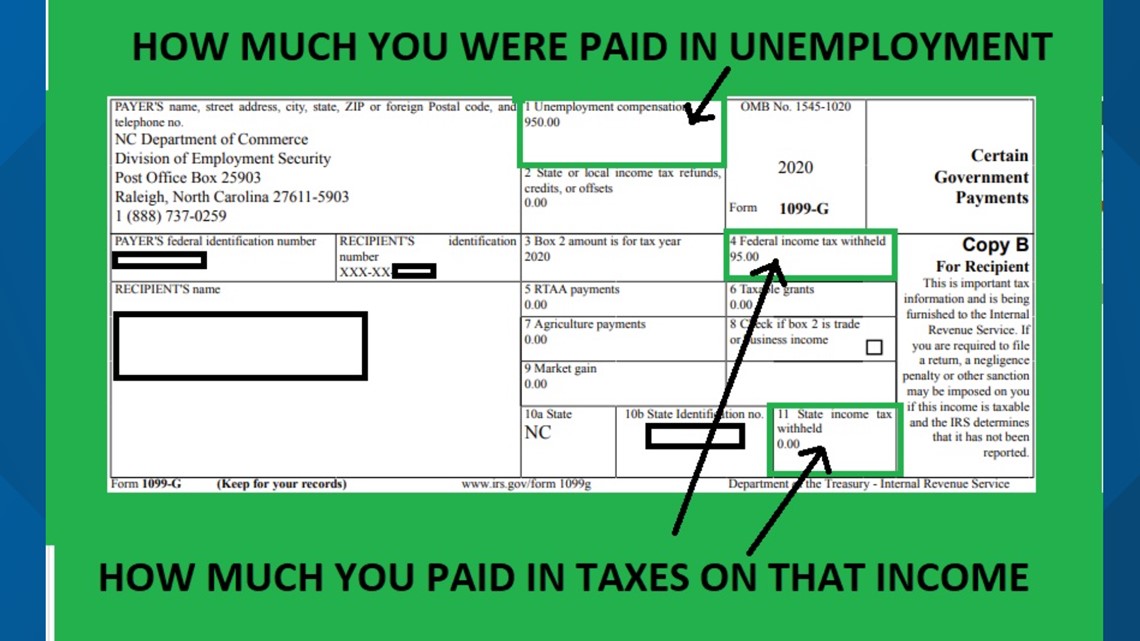

To stay on top of this issue you should adhere to your Form 1099-G which you will receive from the IRS in the mail that will tell you how much you must report in. However New Yorks withholding on unemployment is 25 while the actual income tax owed would be 4.

Unemployment 10 200 Tax Break Some States Require Amended Returns

Do you have to pay state taxes on unemployment.

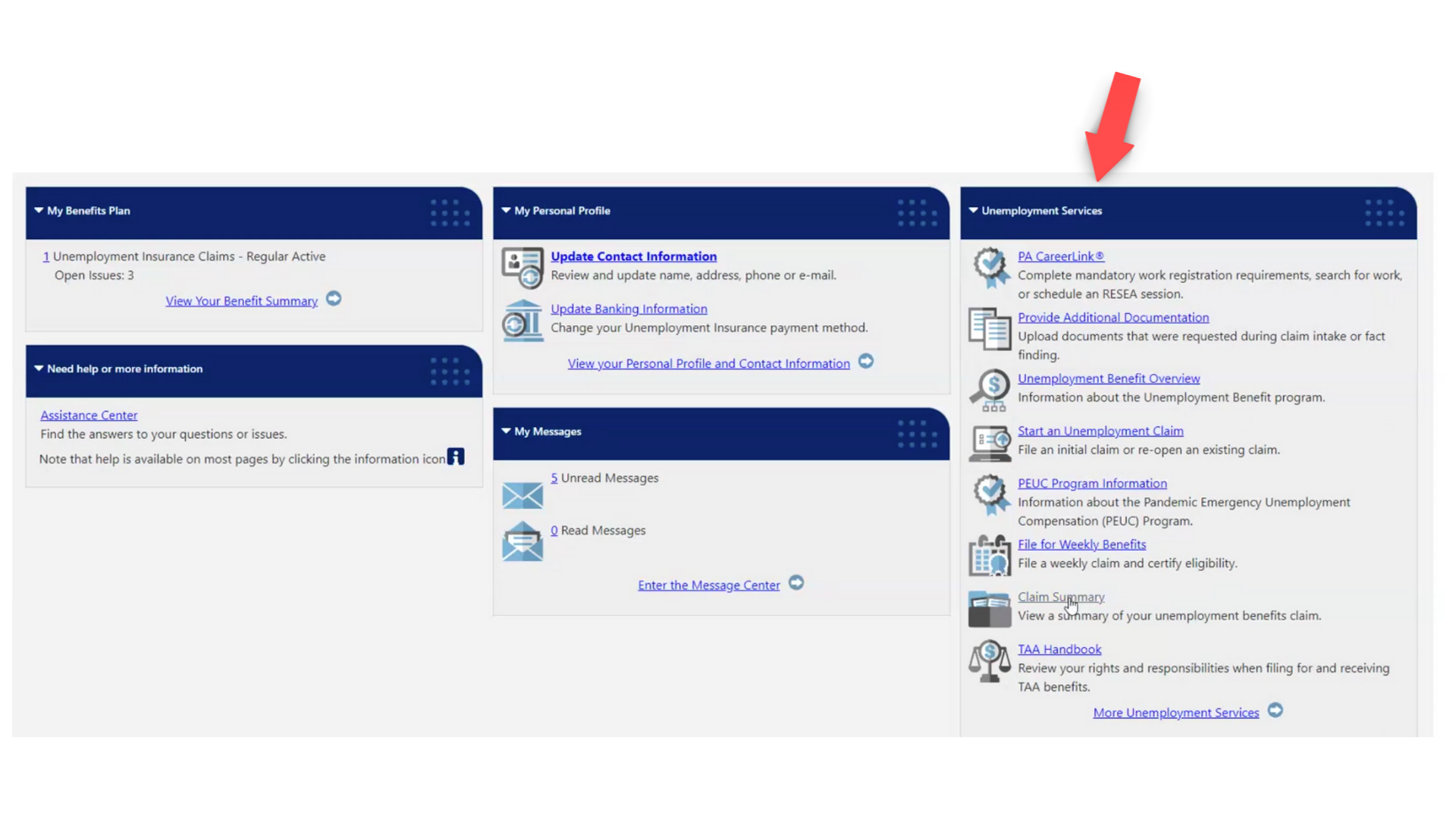

. To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment office. You had other income separate from unemployment. It depends on what state you live in.

These include future Unemployment Insurance benefits contract. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. You received more than 10200 in unemployment benefits and so you owe income taxes on that extra amount.

Unemployment In CA Is Taxable. He can do this online in person or over the phone providing critical. Depending on the state you live in you may owe state.

The maximum weekly benefit at 504 dollars is. If you live in one of the. When she filed taxes for 2020 Freed discovered she owed New York State 1200 for income taxes on unemployment benefits.

If you had taxes withheld on jobless benefits the federal taxes are withheld at a 10 rate. The tax withholding assumes 26 weeks of UI benefits not 9 months plus boosts of 600 and 300 for 16 and 6 weeks respectively. For those who do not normally earn this much and take.

You Could Owe 1200 In Federal Taxes On 300600 Unemployment Boosts. If your state of residence collects income taxes you may have to pay taxes on your benefits to both state. To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment.

If you do not pay back benefits that were overpaid to you we can seize any payments New York State may owe you. Higgins proposes expansion of Historic. On 10200 in jobless benefits were talking about 1020 in federal taxes that would.

You can do the same thing with unemployment income. A worker who loses his job or gets his employment hours cut should file a claim as quickly as is feasible.

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

:max_bytes(150000):strip_icc()/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg)

Important Unemployment Tax Questions For Employers

Woman Unemployed At Start Of Pandemic Learns She Owes State 1200 In Overpayments Wrgb

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

How Unemployment Benefits Can Affect Your 2020 Taxes

You Have To Pay Taxes On Unemployment Checks What You Need To Know

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Benefits Tax Issues Uchelp Org

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Why Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Taxes Will You Owe The Irs Credit Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Unemployment Compensation Is Taxable In Arizona With One Exception

State Income Tax Returns And Unemployment Compensation

Your Guide To Paying Taxes On California Unemployment Benefits Laist

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor